Prosper is a peer-to-peer lending marketplace that offers multiple loans like personal loans, home improvement, and business loans. You can invest in personal loans and start earning a passive income. You can invest as little as $25 and earn an annual average income of 5.7%. Furthermore, you can diversify your portfolio by investing in a variety of loans. Prosper marketplace has an auto-invest function that can help you pre-set target and earn interest automatically.

This Prosper review focuses on peer-to-peer investing, which is a way for individuals to lend money to each other directly. If you are interested in borrowing money, please see our articles on loans for more information.

Prosper Investing: Quick Facts

- Prosper is a peer-to-peer lending marketplace that offers different kinds of loans like personal loans, business loans, and home improvement.

- You can invest a minimum of $25 and start earning an average annual interest rate of 5.7%.

- Prosper has investment features like an auto-invest tool that can help you save time selecting loans to invest in. It also has a mobile app available for Android and iOS users.

Contents

- 1 Who Can Invest in Prosper Marketplace?

- 2 How Prosper Marketplace Works

- 3 How to Invest in Prosper Marketplace

- 4 Prosper Marketplace Features

- 5 Prosper Fees

- 6 Prosper Supported Countries

- 7 Prosper Customer Support

- 8 Is It Safe to Invest in Prosper Marketplace?

- 9 Pros and Cons of Prosper

- 10 Prosper Alternatives

- 11 Prosper Investing: A Good Option for Diversification, But Be Aware of the Risks

Who Can Invest in Prosper Marketplace?

To invest in Prosper Marketplace, you need to meet the following requirements:

- Be a permanent resident of the United States

- Be at least 18 years old

- Have a social security number or Taxpayer Identification Number

- Have a checking or a savings account

How Prosper Marketplace Works

Prosper is a peer-to-peer lending marketplace that offers loans to borrowers. If you lend money to borrowers through Prosper, you will earn interest of 5.7%. The borrower makes a loan application and then Prosper Marketplace reviews the loan application by checking the borrower’s credit worthiness. If the borrower meets the qualification, Prosper Marketplace connects him with you.

Borrowers can apply for loans between $2,000 and $40,000. You can invest small portions in different loans. You will be earning interest as the borrowers continue to make monthly payments. To qualify for a loan, the borrower needs to have a credit score of at least 640. They also need to provide bank statements.

How to Invest in Prosper Marketplace

To invest in Prosper marketplace, you need to follow these simple steps:

- Open an account. You need to sign up on the Prosper website to start investing. You need to provide your name, email address, and contact details.

- Fund your account. You then need to fund your Prosper account using a bank transfer, or credit card transfer.

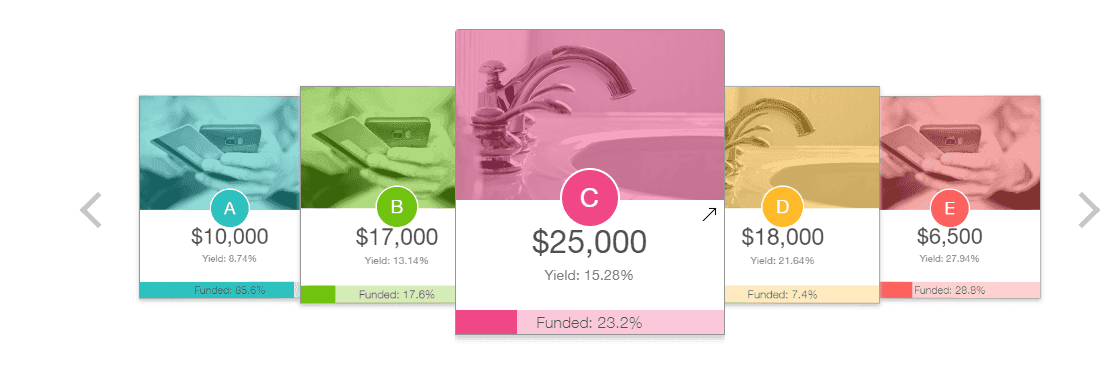

- Select a personal loan to invest in. You need to select an individual loan to invest in. You can do so manually or using an auto-invest feature.

- Start earning. Once you have selected a loan to invest in, Prosper will deposit monthly payments to your Prosper account. You will be earning a 5.7% annual interest rate.

Prosper Marketplace Features

Prosper Marketplace has the following features that are accessible by investors:

Prosper Mobile App

Prosper has a mobile app available for iOS and Android users. You can download the Prosper Invest app to manage your account on the go. With the app, you can adjust your investment portfolio, transfer and allocate funds, set up a new portfolio, add cash to your account, and monitor and manage your portfolio performance.

Prosper Auto Invest

Prosper has an auto-invest feature that automatically invests the available funds based on the pre-set parameters. To use the auto-invest feature on Prosper, you don’t need minimum account requirements nor will be charged any fees. You can set a parameter to select loans to invest in. When there is a loan request that meets the preset parameters, the auto-invest feature places orders for new listings.

Prosper Fees

Prosper charges two types of fees to investors: a loan servicing fee and a collection fee.

The loan servicing fee is a percentage of the outstanding principal balance of the loan that is charged to the investor each month. The annual loan servicing fee is 1%, and it is calculated by multiplying the outstanding principal balance of the loan by the annual loan servicing fee, divided by 365, and then multiplied by the number of days since the borrower’s last payment. For example, if the outstanding principal balance on a loan is $10,000, the annual loan servicing fee is 1%, and it has been 30 days since the last payment, the servicing fee would be $8.22.

If a borrower defaults on their loan, Prosper will hire a collections’ agency to collect the debt. The collections’ agency will charge Prosper a fee for their services, and this fee is passed on to the investor. The collection fee is a percentage of the amount collected by the collections agency and is typically between 25% and 40%. For example, if a collections’ agency manages to collect a $100 payment and their agency fee is 25%, the collection fee would be $25 and be subtracted from the full payment amount received from the borrower. The remaining $75 would be allocated to the loan.

Prosper Supported Countries

To invest in Prosper, you must be a permanent resident of the United States. You must also have a social security number, Taxpayer Identification Number, and a checking or savings account.

Prosper Customer Support

You can contact Prosper customer support by phone: at 866-615-6319, or by email: at support@prosper.com. You can call them between 9 am and 5 pm on weekdays and between 9 am and 5:30 pm on weekends.

Is It Safe to Invest in Prosper Marketplace?

Prosper is a safe and secure investment platform. It is licensed and regulated in the United States. Also, the cash balance in your Prosper Investment account is FDIC insured by Wells Fargo Bank, N.A. however, it is worth noting that funds lost due to a borrower’s default or poor Note performance are not FDIC insured.

As a peer-to-peer lending platform, it means that you are lending money to individuals and businesses directly. This can be a riskier investment than traditional investments, such as stocks and bonds. If a borrower defaults on their loan, you could lose some or all of your investment.

One common complaint about Prosper is its lack of customer support. Some customers have said that it is difficult to get in touch with Prosper customer service representatives, and that they are not always helpful when they do get in touch.

Prosper investing tips

- Based on our research findings, one of the biggest risks in P2P lending is the risk of default. Many defaults occur in high interest (high risk) loans from low grade borrowers. To avoid this, it is important to spread your loans across evenly in very small amounts and to diversify your portfolio by investing in a variety of borrowers. You should also consider investing in a P2P lending platform that has a good track record of on-time repayments.

- Peer-to-peer lending can be a good way to earn a higher return on your investment than you would on traditional savings accounts, but it is important to be aware of the risks involved and to take steps to mitigate them.

- Another important factor to consider is the tax implications of P2P lending. P2P lending interest is taxed as ordinary income, which has unfavorable treatment compared to qualified dividends and long term capital gains. This means that you will pay higher taxes on your earnings from P2P lending than you would on other types of investments.

- To reduce your tax burden, you should rebalance your portfolio regularly to ensure that your desired risk-reward profile is maintained. You may also want to consider spreading your loans out over the month, so you receive small payments throughout the month. This will help to cashflow your investments and make it easier to reinvest your earnings.

Pros and Cons of Prosper

Advantages of Prosper

- Potential for attractive returns. Prosper investors have historically earned average returns of around 5.7%. This is higher than the average return on many other types of investments, such as CDs and bonds.

- Diversification. Prosper allows you to diversify your portfolios by investing in a variety of different loans. This can help to reduce risk and increase overall returns.

- Flexibility. You can choose how much money you want to invest and which loans you want to invest in. You can also choose to reinvest your earnings or withdraw them at any time.

- Transparency. It provides you with a lot of information about the loans they are investing in, including the borrower’s credit score, debt-to-income ratio, and purpose of the loan.

Disadvantages of Prosper

- Risk of default. There is always the risk that borrowers will default on their loans, which could result in your losing money. Prosper has a number of safeguards in place to minimize this risk, but it is still a possibility.

- Origination fees. It charges origination fees to borrowers on all loans, which can range from 1% to 5%.

- High interest rates. Prosper loans typically have high interest rates, which can make them expensive for borrowers.

- Limited repayment term options. You can only choose from three- or five-year terms.

Prosper Alternatives

The following are Prosper Marketplace competitors:

Prosper Investing: A Good Option for Diversification, But Be Aware of the Risks

Prosper is a peer-to-peer lending platform that allows you to lend money directly to borrowers. You can earn an average annual interest rate of 5.7%. It is a good option for investors who are looking for a way to potentially earn attractive returns while also diversifying their portfolio. To invest in Prosper, you need to be a permanent resident of the United States.

One of the benefits of investing in Prosper is that it can help you diversify your portfolio. By investing in a variety of different loans, you can reduce your risk. Additionally, Prosper offers an auto-invest feature that can save you time by finding loans to invest in on your behalf.

Thousands of Prosper investors have had a positive experience and earned average returns higher than they would have earned on many other types of investments. However, it is important to be aware of the risks involved, such as the risk of default and origination fees. There is always the possibility that borrowers will default on their loans, which could result in your losing money. However, Prosper has a number of safeguards in place to minimize this risk, such as credit checks, income verification, and loan diversification.