In the world of global finance, the concept of a closed currency is a fascinating one. Closed currencies are those that are exclusively available within the borders of their country of origin, making them off-limits for international circulation. It’s a monetary system where the local currency serves as the sole legal tender, and any attempt to leave the country with it is deemed illegal.

When travelers arrive in a nation with a closed currency, they must exchange their local currency for the currency of that particular country. Likewise, when departing, they must convert the closed currency back into their preferred currency. This practice ensures the nation’s monetary stability and saves travelers from the extra cost of currency conversion fees for everyday purchases, as they can conveniently exchange their currency upon arrival, often at the airport.

As of 2024, several countries around the world still uphold the closed currency system. These nations restrict the use and circulation of their currency beyond their borders. To shed light on this intriguing phenomenon, we have compiled a list of countries that maintain closed currencies in the present day. Understanding the dynamics of these currencies offers valuable insights into the unique financial ecosystems that exist globally, where the exchange of money is governed by distinct rules and regulations, often deeply rooted in a nation’s economic history and policies.

What is a Closed Currency?

A closed currency is a currency that is only available in the country of origin and not freely available in other countries. A closed currency is only available in the country of origin, and it is illegal to travel out of that country with the currency. When you arrive in that country, you need to exchange your local currency to that particular currency. Furthermore, while departing from the country, you need to change that closed currency to your preferred currency.

People travel around the world and they need money for their day-to-day activities. When you change the currency to that one used in that particular country, it will save you the cost since you would rather not pay conversion fees for purchases you make. Therefore, you can exchange your currency when you arrive at the airport in that country with a closed currency.

Contents

- 1 What is a Closed Currency?

- 2 Why Do Countries Have Closed Currencies?

- 3 Countries with Closed Currency as of 2024

- 4 Travel Tips to Countries with Closed Currencies

- 5 How to Access Closed Currency

- 6 Relationship between Closed and Restricted Currency

- 7 Closed Currencies and Their Impact

- 8 Closed currencies FAQs

Why Do Countries Have Closed Currencies?

There are several reasons why countries choose to implement closed currencies, all of which generally aim to protect and manipulate their economies. They include the following:

- Economic Stability: Closed currency policies can help maintain stability in the domestic economy by controlling the flow of capital in and out of the country. This can prevent rapid fluctuations in the exchange rate and reduce the risk of currency speculation, which could destabilize the economy.

- Foreign Exchange Reserves: By restricting the convertibility of their currency, countries can preserve their foreign exchange reserves. This is particularly important for countries with limited reserves or those facing balance of payments challenges.

- Monetary Policy Control: Closed currency policies give central banks greater control over monetary policy. By managing the supply of money and credit within the economy, central banks can influence interest rates, inflation, and overall economic growth.

- Protectionism: Closed currency policies can be used as a form of protectionism to safeguard domestic industries and promote economic self-sufficiency. By restricting access to foreign currencies, governments can reduce imports and promote domestic production.

- Political Considerations: In some cases, closed currency policies may be driven by political considerations, such as national sovereignty or security concerns. Governments may view control over the currency as a way to assert independence or protect against external influences.

It’s important to note that closed currency policies can have both benefits and drawbacks. While they may help maintain economic stability and control, they can also restrict international trade and investment, limit access to foreign capital, and hinder economic growth.

Countries with Closed Currency as of 2024

The following is a list of closed currency countries across the globe.

| Country | Currency |

|---|---|

| Bahamas | BSD |

| Armenia | AMD |

| Albania | ALL |

| Cambodia | KHR |

| Cameroon | XAF |

| Cuba | CUP |

| Ghana | GHS |

| Georgia | GEL |

| Ethiopia | ETB |

| Iran | IRR |

| Laos | LAK |

| India | INR |

| Myanmar | MMK |

| Morocco | MAD |

| Libya | LYD |

| Nigeria | NGN |

| North Korea | KPW |

| Nepal | NPR |

| Samoa | WST |

| Sri Lanka | LKR |

| Sudan | SDG |

| Tunisia | TND |

| Ukraine | UAH |

| Uzbekistan | UZS |

| Tunisia | TND |

| Zimbabwe | ZWL |

| Venezuela | VES |

Travel Tips to Countries with Closed Currencies

You need to be careful while traveling to countries with closed currencies. For instance, make sure to exchange the closed currency to your home country currency before departing that country. Closed currencies are not freely available in other countries, and this may give you difficulties when exchanging it in your home country. The following are some tips.

- Retain the money exchange receipts, just in case you may need to use them as a proof that you obtained the money in the right channels.

- Avoid carrying large sums of foreign currencies, since they are usually in high demand. For instance, Euros, USD and GBP.

- Use travel cards, debit, or credit cards when you travel. They charge fair fees at the ATMs and have high exchange rates.

- It is illegal to transact with some currencies in some countries. Therefore, make sure to research about the currency of the country you are traveling to before departing your home country.

- Estimate the amount of money you need during your stay in that particular country so that you do not have to exchange it back before departing.

- If you are not sure about the currency of the country you are traveling, contact the relevant embassy before traveling.

- In many countries with closed currencies, there are black markets that offer higher exchange rates. Don’t get tempted to use these black markets because of their higher rates. If you are caught, you will face the authorities of that particular country, something you might not want to happen to you.

How to Access Closed Currency

To exchange your currency to the closed currency, you must do it in the bureau de change or banks. Make sure to do so immediately you arrive in the country to avoid the costs of converting the currency when making every transaction. Many countries have their bureau de change in the airport. If you have a credit, debit or travel card, you can use it to withdraw cash from any ATM.

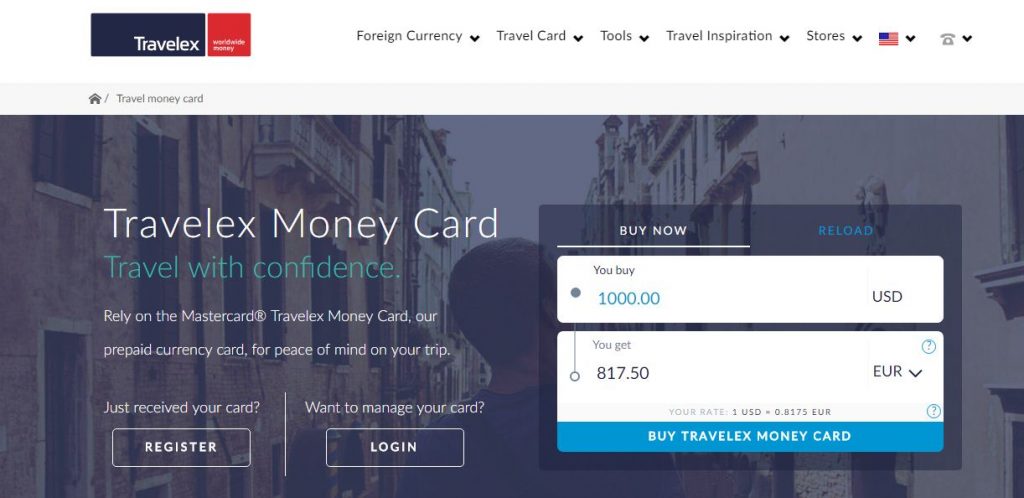

Luckily, some travel cards do not charge ATM fees, such as the Travelex Money Card Platinum. Make sure that the card is loaded with different currencies so that you can convert from one currency to another using the ATM. Make sure you are aware of the exchange rates. Alternatively, you can carry cash or travel cheques to exchange when you arrive. Damaged, torn and new denominations not yet recognize are not accepted.

Relationship between Closed and Restricted Currency

A closed currency is related to a restricted currency in that both cannot be used outside the country of use. In most cases, countries with currency restriction or closed currency have had a history of protectionism or economic policy. Most countries with closed currencies are the same ones that have restricted currencies.

Closed Currencies and Their Impact

Closed currencies, with their limitations on convertibility and movement, reflect a deliberate approach by governments to manage economic stability and control capital flows. While such policies can serve to stabilize exchange rates and protect domestic industries, they also pose challenges for international trade, travel, and investment. Understanding the reasons behind closed currency systems is crucial for businesses and individuals navigating global markets.

For travelers, it’s essential to conduct a background check on the currency of the country you’re traveling to. When departing a country with a restricted currency, it’s advisable to exchange it for your home currency or transfer it before leaving to avoid complications. Staying informed about closed currency regimes is key for informed decision-making and strategic planning.

Closed currencies FAQs

Wat does closed currency mean ?

A closed currency is a currency that is only available in the country of origin and not freely available in other countries. It is also illegal to travel out of that country with the currency. If you spend money, you need to exchange your local currency to that particular currency. Furthermore, while departing from the country, you need to change that closed currency to your preferred currency.

Is Sri Lankan rupee a closed currency?

Yes, the Sri Lankan rupee is indeed a closed currency. This means that you cannot buy or sell it outside of Sri Lanka.

Why is the Moroccan dirham a closed currency?

The Moroccan dirham is a closed currency. This policy aims to control capital flight, protect domestic industries by encouraging local purchases, and manage foreign exchange reserves for import obligations.