Index funds are some of the biggest in the industry yet so many beginners don’t understand them. Here is everything you need to know about index funds. There are a number of types of index funds but what are the Most Popular Index Funds? And how can you Invest in these Index Funds?

This article on index funds for beginners will explain to you what these funds are and how you can invest in them. But first a little history. Because where does investing in index funds come from?

Index Funds: models of investment

- In his 2017 annual letter to shareholders, Warren Buffet praised John Bogle and said that Bogle had done more for American investors than any other investor in history. Why was that?

- For starters, Bogle was an American investor who founded Vanguard, the largest investment company in the world with more than $6 trillion in assets under management.

- Unlike hedge fund, Vanguard uses a mutual fund model of investment. This is a model that has been promoted by Bogle for more than 4 decades.

Contents

- 1 Index funds explained: What is an Index Fund?

- 2 Types and examples of Index Funds

- 3 The Most Popular Index Funds

- 4 Benefits of Investing in Index Funds

- 5 How to Invest in Index Funds

- 6 List of Some of the Most Popular Index Funds

- 7 What is the Best Way to Invest in Index Funds?

- 8 Are Index Funds Diversified?

- 9 Index Funds vs ETFs

- 10 Index Funds Robinhood

- 11 Final Thoughts on Index Funds

Index funds explained: What is an Index Fund?

In recent years, one of the biggest debates in the financial market has been about passive and active management. There have been proponents and opponents of the two in both sides. In active management, an investor spends time learning about the market and initiating individual trades. By doing this, they believe that they can outperform the market. Passive proponents on the other hand believe in investing in a collection of stocks. Index funds allows them to do this. For example, if you buy an S&P 500 index fund, you are essentially investing in the 500 companies that market. In recent years, the passive investment industry has seen inflows worth trillions of dollars.

Types and examples of Index Funds

There are a number of types of index funds. Broadly, they are categorized into geography, industry, and company size. Based on geography, there are index funds that are created based on where the companies are from. For example, the Vanguard emerging markets stock index fund investor shares offers an investor exposure to the emerging markets. The fund has investments in companies like Taiwan, China, and Russia. Based on company size, an index like the Vanguard Small-Cap index Fund Shares (NAESX) provides an exposure to the small-capitalization US stocks. Based on industries, you can invest in the following sectors:

- Technology index funds. This is an index made up of companies in the technology sector like Twitter, Facebook, and Google.

- Financial Sector. This is an index made up of financial companies like Citigroup, Goldman Sachs, and Blackrock.

- Consumer Staples. This is an index made up of consumer staples companies like PepsiCo and Coca Cola.

- Consumer Discretionary. This is an index comprised of consumer products that are thought of as non-essential. Examples are Cinemark, Disney, and United Continental.

- Telecoms. These are companies like Verizon, AT&T and Sprint.

- Energy. These are companies like ExxonMobil and Occidental Petroleum.

- Healthcare. These are companies like Pfizer and Gilead Sciences.

- Industrials. These are companies like 3M, Illinois Tool Works, and Boeing.

- Transports. These are companies like Delta, United, and American Airlines.

- Utilities. Examples are companies like Nextra Energy, Exelon, and Dominion Virginia Power.

- Real Estate. These are companies that specialize in real estate like Simons Property Group and Prologis.

The Most Popular Index Funds

In the United States, the most popular index funds are the S&P 500, Dow Jones Industrial Index, Nasdaq, and Russell. The S&P 500 index is made up of the 500 biggest companies in the US while the Dow is made up of 30 large companies that are viewed as a good representation of the US. The Nasdaq index is mostly biased to the technology sector while the Russel is made up of the biggest small cap companies. In addition to these, investors seeking international exposure buy index funds like DAX (Germany), FTSE 100 (United Kingdom), CAC (France), Hang Seng (Hong Kong), and Nikkei (Japan).

Benefits of Investing in Index Funds

There are a number of advantages that come with index funds. These are:

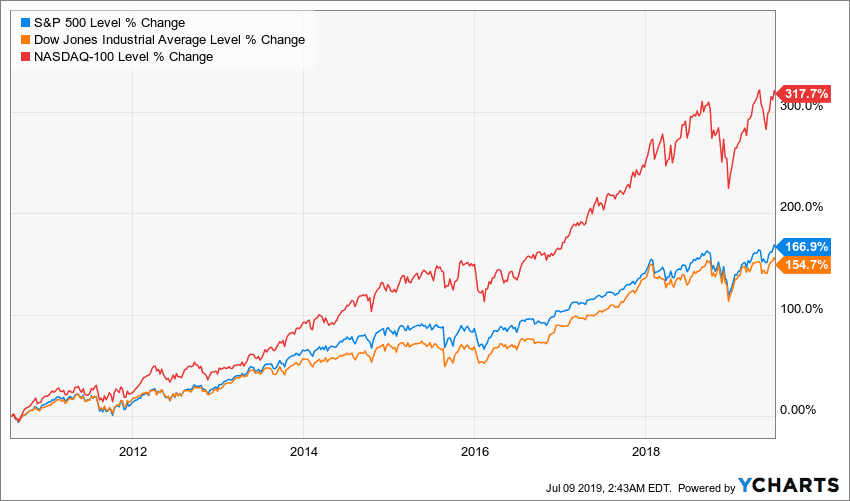

- The overall performance of key index funds has been great. As shown below, the main US indices have risen by more than 100% in the past ten years.

- By investing in index funds, you are diversifying your portfolio. The benefit of being diversified is that losses in one stock are offset by gains in another.

- Investing in index funds is usually cheaper than being an active manager. The little transaction costs that you pay to your broker can add up. If you are using a fund manager, the fees you pay too can be very high.

- There is no reliable method of finding reliable fund managers you can trust. Investing in an index removes that risk.

- You will have peace of mind, knowing that you have invested in many companies at once.

- You don’t need to know a lot about the companies like valuation and management.

- There are tax incentives to investing in index funds.

How to Invest in Index Funds

In the United States, index funds are offered by a number of large companies. The biggest companies that offer mutual fund services are: Vanguard, Fidelity, SPDR, Blackrock, and American Funds. To invest in index funds, you should follow the following steps.

- Think about the market you want to invest in. As mentioned above, there are several options of index funds that you can chose from. If you want to invest in technology companies, you can invest in the SPDR® S&P Software & Services or the First Trust NASDAQ Technology index fund.

- Decide on how you will buy the funds. Here, you need to think of the broker you want to use. We recommend that you use RobinHood, which offers a free method to invest in index funds. Alternatively, you can use a robo advisor like Wealthfront and Betterment for this.

- Compare the costs. This is simple. Select index funds from companies that offer lower costs.

- Diversify. Finally you should diversify your index funds investments.

List of Some of the Most Popular Index Funds

There are so many index funds in the United States. These funds are created by large institutions like Blackrock, Vanguard, and Charles Schwab. Here is a good list of some of the best index funds to invest in:

- Vanguard 500 Index Investor Share Class (VFINX) – This index invests in all companies in the S&P 500 in equal weighting.

- Fidelity 500 index – This index invests at least 80% of its assets in stocks in the S&P 500.

- Fidelity® MSCI Information Tech index – This index invests in the biggest technology companies in the world.

- iShares Expanded Tech Sector index – This also invests in technology companies. These companies are known for their fast-growth.

- SPDR S&P Semiconductor index – This index invests in semiconductor companies like Intel, Nvidia, and Qualcomm.

- SPDR S&P Software & Services – This invests in software and SAAS companies in the S&P 500

When looking for the index fund to invest in, it is recommended that you look at the expense ratio and the historic performance. Historic performance is not an indication of what will happen in future. However, it can give you an indication of what you can expect.

What is the Best Way to Invest in Index Funds?

Investing in index funds is relatively easy. It is possible to invest in funds online, using one of the most popular brokers. Fortunately, the brokerage industry has seen increased changes, which is a good thing for consumers. Most of the biggest brokers have brought their commissions to zero. This means that you don’t need to pay anything to invest in index funds. Here are the best brokers you can use to invest in index funds:

- Charles Schwab

- Fidelity

- TD Ameritrade (the company is in talks to be acquired by Schwab)

- E*Trade

- SoFi

Are Index Funds Diversified?

As mentioned above, an index funds is comprised of many stocks. Therefore, the answer is yes that index funds are diversified. There are sector-specific index funds such as those in the materials, technology, financial, semiconductors, and utilities. There are other index funds that have companies in most industries.

Index Funds vs ETFs

A commonly-asked question is on the difference between index funds and ETFs. These products are similar in many ways but you will also find some inherent similarities. They are similar in that they all offer diversified products. In fact, you will find some index funds and ETFs that are similar in composition. There are differences as well. For example, the expense ratio of index funds is usually a bit higher than that of ETFs. Another difference is that ETFs are traded in the market just like stocks while index funds (mutual funds) are traded at the end of the trading day.

Index Funds Robinhood

If you are interested in investing in index funds, Robinhood does not offer them directly. It offers ETFs, which you can invest in.

Final Thoughts on Index Funds

Index funds are some of the best investment products available in the market today. These products allow you to invest in a group of companies in an easy method. In fact, recent research finds that passive investments have performed better than active funds for the past decades. Therefore, while this index funds for beginners has answered some of the most frequently asked questions, we recommend that you read more about the topic. Some of the best books on the topic that you can read are: The Little Book of Common Sense Investing by John Bogle, Investing Made Simple: Index Fund Investing and ETF Investing Explained in 100 Pages or Less by Mike Piper, and Index Funds and ETFs: What they are and how to make them work for you by David Schneider.