Trim, also known as AskTrim, is an app that offers bill negotiation services and cancels your unwanted subscriptions. The app also provides a high-yield savings account, financial coaching, automatic credit card payments, and debt payoff services.

Trim Bill in a Nutshell

- Opening a Trim account is free. However, if Trim successfully negotiates your bills down, they will take up to a third of your total yearly savings.

- Trim offers a savings account that comes with a 4% annual reward on the first $2,000 that you save and a rate of 1.1% after.

- The best Trim app alternative is Hiatus app.

Contents

How to Sign Up to Trim

Trim is an app that you won’t find in the App Store or Google Play. To get started with Trim, visit Trim’s website and create a free account using your email address, Google account, or Facebook account. Once you log into your account, connect your bank account and credit card accounts and link your SMS or Facebook Messenger (for communication purposes) and then Trim will start analyzing your all your payment history to identify ways to save you money.

How the Trim App Works

Trim offers several services to help you save money but it is well known for its automated bill negotiation tool. The following is how Trim works:

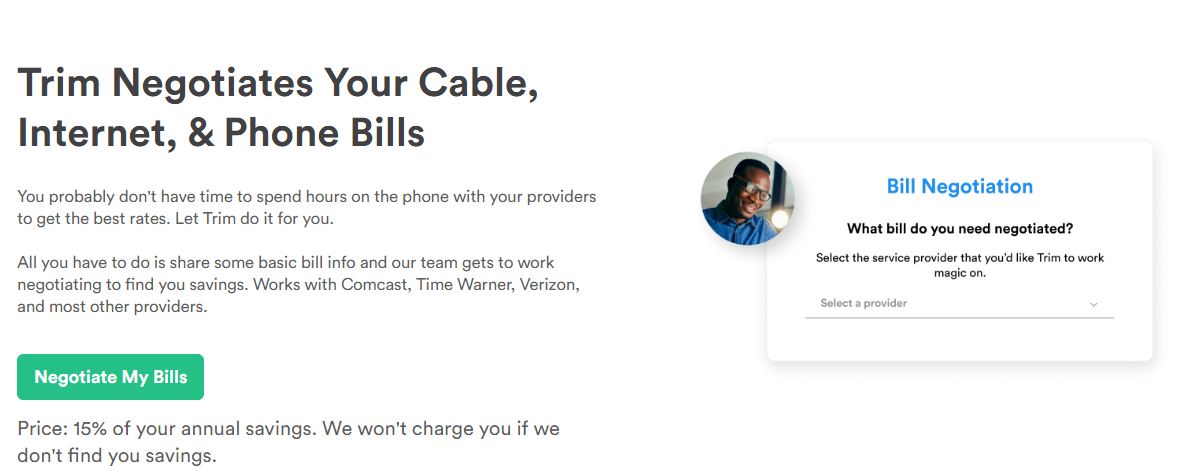

Trim Bill Negotiation

Just like the Hiatus App, Trim negotiates for lower rates for your bills with your service providers (internet, car insurance, cable service, and/or phone company). It works with several service providers such as Mediacom, Charter, Sprint, Time Warner, Verizon, AT&T, Spectrum, Comcast, and more.

If your bill is too high and you want it reduced, submit the bill to Trim for negotiation. You can do this by sending a photo of it or find your provider on the Trim dashboard. Trim robots will chat with your service provider requesting them to get your bill down. Alternatively, someone from the Trim team will make a call to your service providers to negotiate your bill. Trim can help to get your bills down by up to 30%. You will only be charged when the negotiation is successful.

Trim also offers medical bill negotiation services on your behalf. All you need to do is share your bills for doctor’s office visits, hospital stays, and other medical services with Trim. Trim will work with your medical services provider to possibly lower your bills, get better rates, or find a convenient payment plan. AskTrim can also negotiate bank account fees and credit card APRs.

Trim Subscriptions Service

Trim has the ability to isolate and cancel unwanted subscriptions. Trim does this by tracking your transactions from your linked checking and credit card accounts. It analyzes these transactions to identify frequent or recurring subscriptions. Then, Trim alerts you about these subscriptions and shows you how much you are spending on them. You will decide whether you’d like to cancel or not. If you want to cancel a certain subscription, simply select it and Trim will cancel it for you and also update you on the status of the cancellation.

Trim Premium Services

Trim Premium is Trim’s new paid service that costs $10 per month. Trim Premium features a savings account, financial coaching, debt calculator, and automatic credit card payments.

- Trim High-Yield Savings Account. Trim’s brand new savings account comes with a 4% annual reward on the first $2,000 that you save and a rate of 1.1% after. Within the Trim app, you can schedule automated transfers in your savings account.

- Financial Coaching. Trim Premium users have unlimited email access to Trim’s team of financial planners. You can ask them questions concerning saving for retirement, paying off debt, emergency funds, and more.

- Automatic Credit Card Payments. The TrimPay feature helps you pay off your credit card debt faster. All you need to do is pick the credit card you want to pay off. Next, set up automated weekly bank transfers to your TrimPay account and pick a day of the month for the total in your TrimPay account to be sent to your credit card company. TrimPay works with one credit card at a time.

- Debt Calculator. Trim will analyze all your debts and help you build a payoff plan that minimizes interest.

If you no longer need your Trim Premium subscription, you can cancel it anytime. Log into your Trim account and navigate through and click the “Unsubscribe from Premium” button. Alternatively, you can email customer support at help@asktrim.com for help. Cancelling your Trim Premium subscription will not delete your free Trim account.

How Much Does Trim Cost?

Opening a Trim account is free. Other free services include setting up spending alerts and personalized reminders, finding subscriptions and cancelling them, accessing your personal finance dashboard, and detecting overdraft or late fees and fighting them. However, if Trim manages to successfully negotiate your bills down, they will take up to a third of your total yearly savings. Also, Trim’s savings account costs $2 per month while Trim’s Premium features cost $10 per month.

Is Trim Safe to use?

Yes. Trim is as safe like many other money management apps. It uses Plaid to collect your banking information and it never receives nor stores your banking data. Additionally, Trim’s website and server both use 256-bit SSL encryption. To add to their security, they request two-factor authentication when you sign up for their service. Trim hosts all the customer data it collects on Amazon Web Services (AWS).

Trim Customer Reviews

The Trim bill app is a legit bill negotiation app that has attracted positive reviews from satisfied customers. With Trim, you only pay them if they manage to save you money and customers love this. At the time of writing, it has been rated 4.2 out of 5 stars from over 1, 144 reviews on Trustpilot. Most negative reviews on Trustpilot are from customers complaining that Trim could not save them much money.

Trim Customer Support

In case of any questions or concerns regarding the app or your membership, you can reach the support team through email at help@asktrim.com. Questions regarding their banking services should be emailed to Evolve bank at help@synapsefi.com.

Trim Bill Negotiation Alternatives

If the Trim app is not the best choice for you, check out the following alternatives:

Final Thoughts on Trim Bill Negotiation Review

Trim is one of the best apps to help you save money if you have unwanted subscriptions, out-of-control cable bills, or recurring charges without you having to deal with it. Trim is also simple to use since communication is through text messages or Facebook Messenger chats. The best thing about the app is that most of its services are free.