The stock market is the best place to make money in the United States. Take a look at the Forbes list of the wealthiest Americans and you will realize that most people in that list made their fortune in the stock market. Without Wall Street, people like Bill Gates, Warren Buffett and Jeff Bezos would not be the billionaires they are today. The companies they founded would not be as large as they are. In this article, I will guide you on how to invest in stocks even when you don’t know where to start.

Contents

How the Stock Market Works

To understand how you can most easily invest in the stock market, you need to understand how the market itself works. It all starts when a company is started. When an entrepreneur starts a company, the go to venture firms or banks to get money.

As the company continues to grow, there is demand for more money. The best place to get this money is in the stock market. For this reason, the company gathers a bunch of bankers and they sell part of the company to investors through an initial public offering (IPO). After the company becomes a public company, investors are able to buy and sell the outstanding shares. The price of the stock increases as its demand continues to increase.

As an investor in a company, you will make money in two ways. First, you will make money as the share price increases. This is determined by the demand of the stock. Second, you will make money as the company returns the funds to investors through dividends.

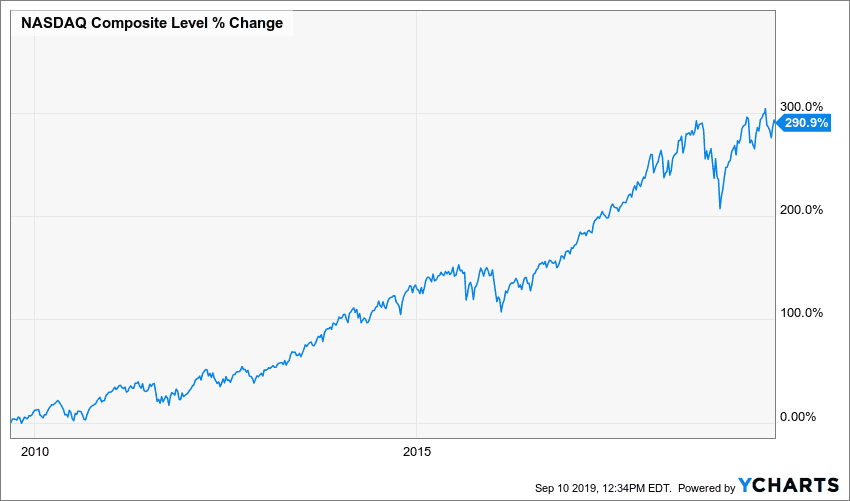

The chart below shows the performance of technology stocks in the past ten years.

How to Invest in Stocks: Learn About Stocks

If you are a beginner, the first thing you need to do is to spend some time reading about stock and the stock market. There is no short cut to this. Fortunately, you don’t need to go to a library to buy a book on stocks. No. You can find these books in the internet in places like Amazon or Barnes and Noble. There are types of investment books that you should read. These are:

- Books from legendary investors. Examples of these are: A random walk down wall street by Burton Markiel, The Intelligent Investor by Benjamin Graham, and Essays of Warren Buffett by Laurence Cunningham.

- Books on Economics. Examples of these are Principles of Macroeconomics by Gregory Mankiw and Advanced Macroeconomics by David Romer.

- Books on Finance. Examples of these are The Little book of common sense investing by Jack Bogle and One up on Wall Street by Peter Lynch.

Books from legendary investors will give you their views about the market and how they succeeded. Books on macroeconomics will guide you on how to interpret economic data in relation to the stock market. Books on finance will teach you things like valuing a company and how to select a good investment.

Learning is not only about reading books. It also involves things like watching financial media like Bloomberg and CNBC. These platforms will help you think the same way investors think. Also, it entails finding a mentor, who will guide you as you invest in stocks.

How to Invest in Stocks: Find a Good Broker

Investors are connected to one another by a broker. The broker is simply a company that will initiate and close orders. They have the access to the market. In the United States, there are several stock brokers that you can use.

The most common ones are:

- Robinhood – Free execution.

- Fidelity – $4.95 per trade

- E-Trade – $6.95 per trade

- Schwab – $4.95 per trade

- Merrill Edge – $6.95 per trade

- TD Ameritrade – $6.95 per trade

Things to consider

There are a few things that you should consider when selecting a stocks broker.

- First, you should consider the fees that they charge to execute an investment. As shown above, the fees range from $0 to $6.95. As you start your investing journey, we recommend that you go with the most affordable. This is because the costs tend to add up as you execute more trades.

- Second, we recommend that you select a broker who offers more tools. As an investor, you want tools like good charts, a good mobile application to track your investment, and investment research from sell-side analysts. You also want a broker who has a good reputation.

I will tell you how to become rich. Close the doors. Be fearful when others are greedy. Be greedy when others are fearful. – Warren Buffett

How to Invest in Stocks: Create a Strategy

After reading more about stocks, you should now create your investment strategy. You likely know the type of investor that you are. Some good examples of investors are:

- Growth-focused investor – This is an investor who invests in new, and fast-growing companies. Examples of these companies are Uber, Zoom Communications, and Beyond Meat. Most of these companies make losses, so investors look at their growth.

- Value investor – This is an investor who buys undervalued companies and holds them for a while. They hope that investors will come to sense and value the company well. A good example of these investors are Warren Buffett and Dan Loeb.

- Income investor – These are investors who buy large companies primarily for their dividends. Examples of companies that pay dividends are AT&T, Microsoft, and IBM.

- Long-term investor – You can also choose the type of investor you are based on the timeline. A long-term investor buys stocks and holds them for years.

- Short or medium-term investor – In this, your goal is to invest in a company and hold the investment for a short period.

- Sector-focused investor – In this, you will focus on a specific sector within the market. There are many successful investors who have succeeded by focusing on sectors like technology and consumer.

How to Invest in Stocks: Start Investing

After you have learned about investing, found a good broker, and created a strategy, it is now a good time to start investing. As you start, there are a few things that you should remember.

- You should invest in funds that you can afford to lose. It is wrong to invest funds that you will need urgently.

- You should do intensive research before you invest. This means that you should avoid following the crowd.

- Always be diversified. It will help you reduce your chances of risk.

- Don’t overreact. At times, a stock you purchased will decline sharply. Don’t overreact, Doing so will make you unnecessary losses.

- If you can’t pick stocks, we recommend that you invest in quality index funds and low-cost ETFs.

In the short run, the market is a voting machine, but in the long run, it is a weighing machine. Warren Buffett

Final Thoughts on Investing in Stocks

Stocks are the best vehicles to create wealth in the United States. Consider a company like Shopify that has gained by more than 150% this year or Beyond Meat that has soared by more than 400% as a public company. It is the vehicle that has created so many millionaires and billionaires in the country. Fortunately, anyone can succeed as an investor. All you need is to follow the tips in this article to get started. If you find it being difficult, you can invest in index funds that track listed stocks.