If you want to send money internationally from your bank, you have likely been asked to provide certain numbers. Two of the most common ones are SWIFT and IBAN numbers. These numbers help your local bank to initiate payments to the actual person or company you are sending to. This article explains what is an IBAN number, how it differs with SWIFT, and how to validate the number.

Contents

What is IBAN Number?

What is IBAN? IBAN stands for the International Bank Account Number (IBAN). This is a number that is used to identify bank accounts across different countries. Its goal is to simplify the process, reduce errors, and ensure that money reaches the intended person or company.

The idea of creating the IBAN was initiated by the European Committee of Banking Standards (ECBS) with the goal of easing money transfer across the European Union. It was then adopted by other countries especially those in the Middle East and Caribbean.

Is there a US IBAN number? Banks in the United States and Canada do not use the IBAN number.

What is an Example of IBAN Number?

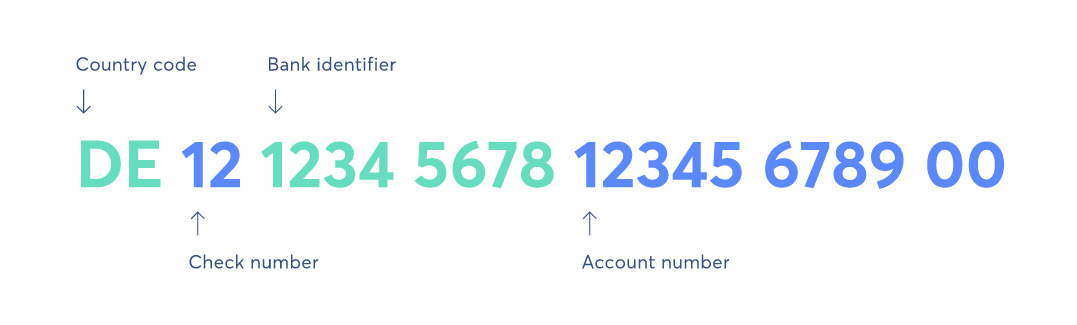

The IBAN format cannot be more than 34 alphanumeric characters that include the country code, two check digits, and a number that has the domestic account number, branch, and the routing information. The check digit is important in the verification of the check by the local bank.

Examples of IBAN numbers for Belgium and United Kingdom are BE71 0961 2345 6769 and GB98 MIDL 0700 9312 3456 78 respectively. German IBAN example is DE89 3704 0044 0532 0130 00. Banks confirm the IBAN number by converting it into an integer and performing a mod-97 operation. If the number is valid, the remainder is equal to 1.

What is IBAN discrimination?: IBAN discrimination is when a bank or company doesn’t accept your IBAN because it’s not from the same country in which the bank or company is based.

What is SWIFT?

SWIFT stands for Society for Worldwide Interbank Financial Telecommunication. It is a neutral organization, and its members include banks, securities dealers, investment funds, and other financial institutions. It is a global network that connects over 11,000 financial institutions around the world. SWIFT does not hold money or settle transactions. Instead, it provides a standardized and secure messaging network that allows financial institutions to communicate with each other and exchange information about financial transactions.

How Is an IBAN Different From SWIFT?

Is IBAN the same as SWIFT? There is often a confusion when it comes to SWIFT vs IBAN. The main difference between IBAN and SWIFT is that while IBAN’s goal is to identify a particular account, SWIFT is used to recognize banks.

The name SWIFT stands for Society for Worldwide Interbank Financial Telecommunication and is headquartered in Switzerland. The number has four main parts, which are a four-letter bank code, a two-letter country code, a two-digit location code, and a two-digit branch code. For example, the SWIFT number for JP Morgan Chase Bank is CHASUS33.

In reality, a SWIFT number works as follows. If a Citi Bank customer in the US wants to send money to a friend who has a bank account in Italy, she will need to have the SWIFT number of the friend’s bank. Citi will then send the payment transfer SWIFT message to the friend’s bank using the SWIFT’s secure network. After receiving the message, the bank will clear the funds to the friend. Most banks around the world have a SWIFT number.

| Feature | IBAN | SWIFT |

|---|---|---|

| Purpose | Identifies a specific bank account | Identifies a specific bank |

| Format | Standardized, 34 alphanumeric characters | Not standardized, 8-11 alphanumeric characters |

| Used for | International payments | International payments |

IBAN vs Account Number

As pointed out earlier, IBAN is a code used to identify individual bank accounts for a cross-border transfer while a bank account are numbers used to identify a specific bank account. Account number is usually the last 8 – 12 digits of on the IBAN number.

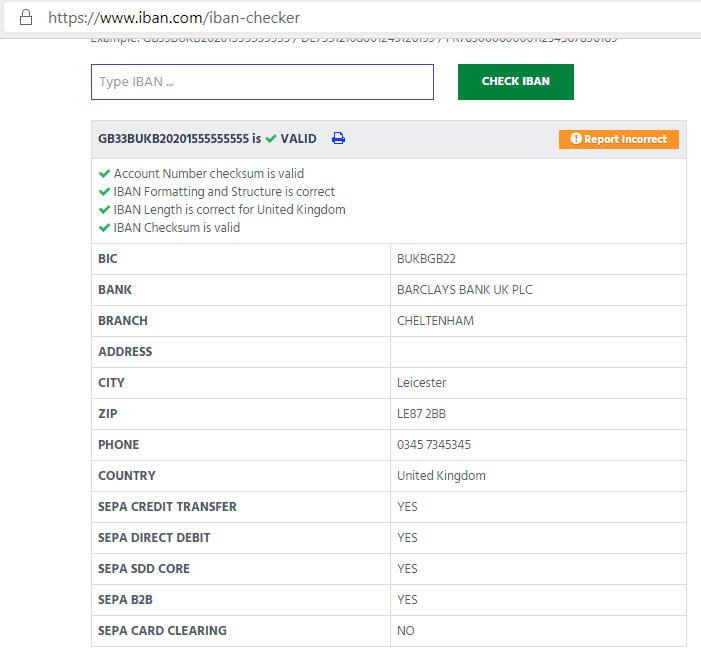

Using the IBAN Checker

When sending funds to a person or a company, it is important to validate whether the number is accurate. To do this, there are many free web and mobile platforms that allow you to check and validate the number. For example, using the IBAN website, the following result was generated.

IBAN Countries List 2023

In the following countries the use of IBAN is mandatory.

| Country | IBAN length | Country code |

|---|---|---|

| Andorra | 24 | AD |

| Austria | 20 | AT |

| Bahrain | 22 | BH |

| Belgium | 16 | BE |

| Bosnia-Hercegovina | 20 | BA |

| Bulgaria | 22 | BG |

| Croatia | 21 | HR |

| Cyprus | 28 | CY |

| Czech Republic | 24 | CZ |

| Denmark | 18 | DK |

| Estonia | 20 | EE |

| Faeroe Islands | 18 | FO |

| Finland | 18 | FI |

| France | 27 | FR |

| Georgia | 22 | GE |

| Germany | 22 | DE |

| Gibraltar | 23 | GI |

| Great Britain | 22 | GB |

| Greece | 27 | GR |

| Greenland | 18 | GL |

| Guernsey | 22 | GB |

| Hungary | 28 | HU |

| Iceland | 26 | IS |

| Ireland | 22 | IE |

| Isle of Man | 22 | GB |

| Isle of Man | 22 | IM |

| Italy | 27 | IT |

| Jersey | 22 | GB |

| Jersey | 22 | JE |

| Jordan | 30 | JO |

| Kazakhstan | 20 | KZ |

| Kuwait | 30 | KW |

| Latvia | 21 | LV |

| Lebanon | 28 | LB |

| Liechtenstein | 21 | LI |

| Lithuania | 20 | LT |

| Luxembourg | 20 | LU |

| Macedonia | 19 | MK |

| Malta | 31 | MT |

| Moldova | 24 | MD |

| Monaco | 27 | MC |

| Montenegro | 22 | ME |

| Netherlands | 18 | NL |

| Norway | 15 | NO |

| Palestinian Territory | 29 | PS |

| Poland | 28 | PL |

| Portugal | 25 | PT |

| Qatar | 29 | QA |

| Romania | 24 | RO |

| San Marino | 27 | SM |

| Saudi Arabia | 24 | SA |

| Slovakia | 24 | SK |

| Slovenia | 19 | SI |

| Spain | 24 | ES |

| Sweden | 24 | SE |

| Switzerland | 21 | CH |

| Tunisia | 24 | TN |

| Turkey | 26 | TR |

| United Arab Emirates | 23 | AE |

The use of IBAN in the following countries is recommended.

| Country | IBAN length | Country code |

|---|---|---|

| Albania | 28 | AL |

| Azerbaijan | 28 | AZ |

| Belarus | 28 | BY |

| Brazil | 29 | BR |

| Costa Rica | 21 | CR |

| Dominican Republic | 28 | DO |

| Guatemala | 28 | GT |

| Iraq | 23 | IQ |

| Iran | 26 | IR |

| Israel | 23 | IL |

| Kazakhstan | 20 | KZ |

| Kosovo | 20 | XK |

| Kuwait | 30 | KW |

| Mauritania | 27 | MR |

| Mauritius | 30 | MU |

| Pakistan | 24 | PK |

| São Tomé and Príncipe | 25 | ST |

| Serbia | 22 | RS |

| Seychelles | 31 | SC |

| St Lucia | 32 | LC |

| Ukraine | 29 | UA |

| Vatican City State | 22 | VA |

| Virgin Islands | 24 | VG |

| East-Timor | 23 | TL |

Read: SEPA Countries List 2021

IBAN and SWIFT: Essential Tools for International Money Transfers

International trade and globalization have led to the need for faster and accurate international money transfer systems. Because of technology and international cooperation, it now takes a few hours to have money sent from one country to another. This has simplified the money transfer system that used to take days and weeks.

IBAN and SWIFT numbers are very important tools when making international transactions. They have made the process faster and safer. They are a proof of what the world can achieve through cooperation and standards.

There’s also a company called Iban Wallet, which is something completely different: Iban Wallet is a modern peer-to-peer lending company that helps individuals and businesses make money by lending to pre-qualified borrowers.

What's IBAN number?

IBAN stands for the International Bank Account Number (IBAN). This is a number that is used to identify bank accounts across different countries.

Is IBAN the same as SWIFT?

No, IBAN and SWIFT are not the same. IBAN is used for identifying bank accounts in specific regions, while SWIFT is a messaging network for secure communication between banks globally.

What country uses IBAN number?

IBAN numbers are used by countries in Europe, as well as some countries outside of Europe. The IBAN system was initially adopted by European countries to standardize and facilitate cross-border transactions within EU and (EEA).

How do I find out my IBAN number?

To find your IBAN number, check your bank statement or online banking account. If you can't find it, contact your bank's customer service. You can also use online IBAN calculators available in some countries.

Do you need IBAN for international transfer?

Yes, for international transfers, you typically need the recipient's IBAN (International Bank Account Number) along with other relevant details such as the recipient's name, address, and the receiving bank's SWIFT/BIC code. However, there are some countries that do not use IBAN numbers for international transfers.

What's IBAN format?

IBAN format varies depending on the country. However, in general, an IBAN consists of a two-letter country code, followed by two numbers, and then up to 30 alphanumeric characters that represent the specific bank account. Here is a typical IBAN format: [Country Code (2 letters)][Check Digits (2 numbers)][Bank Code][Account Number].

What's difference between IBAN and account number?

The account number is a unique identifier for a bank account within a specific bank, while the IBAN is an internationally recognized standard that includes the country code, check digits, and account number. The IBAN is used for international transactions to ensure accurate routing and processing of payments.

What's the IBAN number for UK?

The IBAN for a UK account typically starts with "GB" followed by two check digits and the bank's sort code and account number. The specific format of the IBAN for a UK account is 22 characters long.