Curve is a UK fintech company that offers the Curve Card which allows you to link and manage all your gift cards, debit and credit cards using a single card through a Curve card app. Curve is great for keeping all your cards in one app, but Curve competitors and alternatives are available too.

Contents

Some of the other features that the Curve smart card shares with other companies are instant notifications on spending, go back in time, spending categorization, free ATM withdrawals, and more. This article will discuss companies that are similar to Curve Card and offer similar services (A single card that stores all your debit and credit cards).

What is a good Curve Card Alternative?

- Apps like Curve include services such as VitraCash, cryptMi, Fuze Card, and Lanistar. We review them further below.

- Not all Curve alternatives are at this moment available. Some are in an early beta stage such as VitraCash, while Lanistar is only available in Brazil. Aumax used to be available in France until January 2023.

- Examples of other competitors in the field of money management apps include Empower and Hiatus that are great for spending categorization and automatic money saving.

Alternatives to Curve Card

Below are cards similar curve. However, some Curve competitors are in an early beta stage and some seem to have gone out of service or paused their services. At the moment, the smart card we recommend for linking all your cards because of its features and security is Curve.

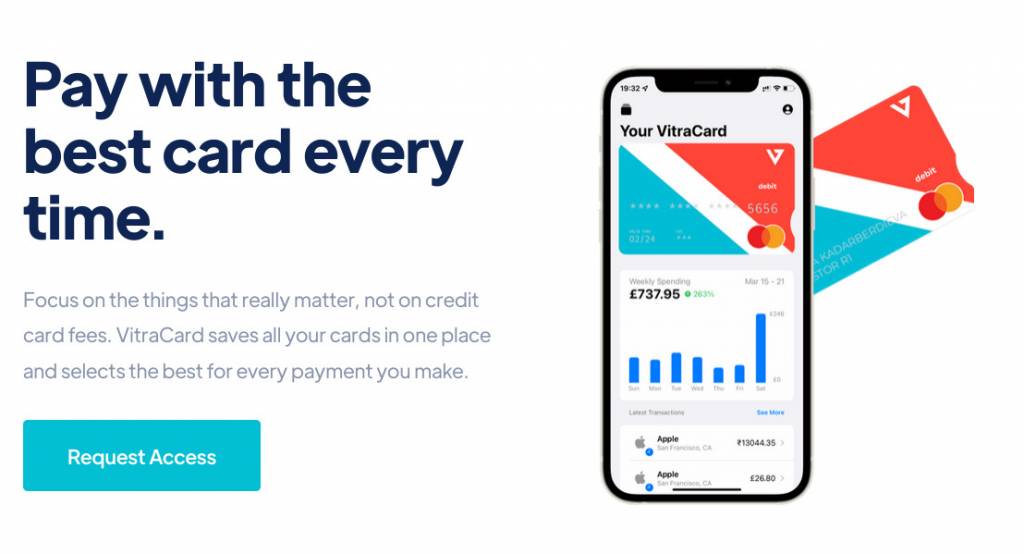

VitraCard Review

VitraCard is a UK-based fintech company founded in 2020 with its first big market being in the UK and the EU. VitraCard offers the VitraCard that saves all your cards in one place and used Artificial Intelligence (AI) to select the best card for every transaction in terms of fees, insurance, and cashback so you can save money all the time. The VitraCard is a MasterCard debit card that is accepted in over 38 million locations worldwide.

The card is in its early launch-phase. The VitraCard app is already live in the App Store. For Android users you can request early access on VitraCard website.

How VitraCash Works

Users can connect all their payment methods to a VitraCard debit card within the VitraCash app. VitraCard claims that it uses machine learning and artificial intelligence technology to select the best card for every transaction. The cards are selected considering elements such as cashback, insurances, loyalty points, FX rates, and discounts.

VitraCard also helps you track your spending with automatic categorization, earn the best rewards on every transaction, get the lowest FX rates, and manage your finances in one place. All these features aim at helping you save money on every transaction.

How to Sign Up for VitraCard and How to Oder Physical Card

As you go through sign up process on iOS, you will be required to complete KYC. Once you have done this, wait 5-10 minutes for the process to complete, then force close your app and re-open it. Once you return to the app, you will be able to order your physical card. Fortunately, you will be given a virtual card immediately after passing the verification step.

cryptMi

cryptMi is a groundbreaking card that is designed to combine your digital assets for everyday expenses. Basically, it offers you the ability to blend various financial instruments, including rewards points, cryptocurrencies, and traditional bank cards, all within a single card, Miles Card. You can make instant swaps between rewards, cashback, crypto and your local currency to pay for everyday essentials.

How cryptMi Works

Signing up for cryptMi is simple; just download the app, follow a few easy steps, and you’re ready to go. Upon signup, you’ll need to add a credit card to access the app. Once set up, cryptMi operates through a dynamic card system, called “Miles Card,” enabling you to blend your digital assets for payments. From transferring funds from supported banks or crypto wallets and exchanges like Coinbase and MetaMask to transfering rewards, cashbacks, and points from platforms like Apple Pay, Samsung Pay, or Google Pay, cryptMi offers flexibility.

You can also make use of features like splitting payments on the go by combining rewards, cryptocurrencies, and local currency, all managed within their cryptMi wallet. For those with finance agreements from BNPL (Buy Now Pay Later) programs like Klarna or Afterpay, CryptMi facilitates balance transfers, allowing continued installment payments. You can also transfer vouchers from various retailers such as OXXO, Boleto, or Konbini to cryptMi. Its a great option for payments across a wide range of scenarios, from everyday essentials to virtual items in the metaverse.

With access to over 100 million locations across the Universe and in the Metaverse, you can shop in-app, in-store, or via contactless methods. Additionally, cryptMi provides access to over 28 million travel deals.

Is cryptMi Safe to Use?

Assessing the safety of CryptMi poses challenges due to its short operational history. Launched in 2022, CryptMi’s limited track record makes it hard to gauge its long-term security and stability compared to more established platforms. Unlike decentralized counterparts, CryptMi operates as a centralized platform, holding custody of users’ funds. This centralized model necessitates trust in the platform’s security protocols and infrastructure.

Fuze Card Review

Fuze Card website is currently down as of February 1, 2024.

Fuze is a smart card device that comes in two variants: the Fuze Standard Card and the Fuze Saffiano Black Card. It combines all your debit/credit cards (Mag-stripe only), gift cards, and loyalty/membership cards in a single digital minimalist wallet. Fuze card does not support EMV chip cards. It is available on Play Store and App Store. It’s a product designed by the company Brilliantts from South Korea. The card cost has a one-time cost of 129 USD.

How the Fuze Card Works

After buying the Fuze Card device, you need to do the following to add your cards. You can store up to 30 different cards in it.

- Barcode. This works with membership cards and gift cards. You can use the camera on your smartphone to capture the your card’s barcode.

- Card reader. This works with credit/debit cards. The card reader connects to your smartphone. You can swipe the magnetic stripe of the card through it and thus register it on the app and on Fuze Card.

- Manually. You can manually copy in membership card details.

Once your cards are added you can go ahead and use them. You select the card that you want use via the buttons on the card. Fuze will then emulate the selected card’s data. In order to pay, you simply swipe the card through the POS machine. The process of turning on the device, selecting the card you want to use, and emulating payment signals with its magnetic signals and barcode will only be authorized by the user via the PIN that you set.

Is the Fuze Card Safe to Use?

The company claims it is. The card protects itself using auto-swipe technology by clearing all data and reverting to factory settings when a pass-code entry error is detected 5 or more times. Also, it has a location tracking and you’ll receive instant notification if you leave it behind, or if it’s on the move without you. Additionally, all transactions are authorized via PIN only known to you. We’re not sure how the magnetic stripe feature bug can still be considered secure though, and how it’s implemented.

Fuze also offers a crypto hardware wallet but we don’t judge their product nearly as good as bitcoin wallet leaders such as Trezor that are a great value for the security of your bitcoin and a better Fuze Card alternative for keeping your crypto safe.

Lanistar App

Lanistar is a polymorphic payment card, meaning you can stack multiple cards in one, and swap between them using Lanistar app. Lanistar card is an all-in-one card for all your cards. Lanistar card is currently only fully operational in Brazil.

How Lanistar Card Works

You simply load the payment cards you want into the Lanistar app and then use any of them directly through your Chrome or Chrome X payment card at merchants around the world who accept MasterCard.

You can store up to eight cards directly inside of the app, and swap between them using a pin pad built into the card. It also lets you generate one-time PINs and CVV2 instantly using the pin pad. You can track your spending across all your payment cards, moving payments from one payment card to another. Furthermore, you can Send, request and split money with anyone.

The Aumax app used to be Curve competitor available to users in France until January 2023, when it shut down. It was compatible with Google Pay, Samsung Pay, Fitbit Pay, Apple Pay, and Garmin Pay. Its Max card allowed you to combine/aggregate your bank cards (up to 5 cards) into one and control them from the Max application.